Large Call to Action Headline

Income Management

Calculating Your Household Income for Marketplace Coverage: What Counts and What Doesn’t

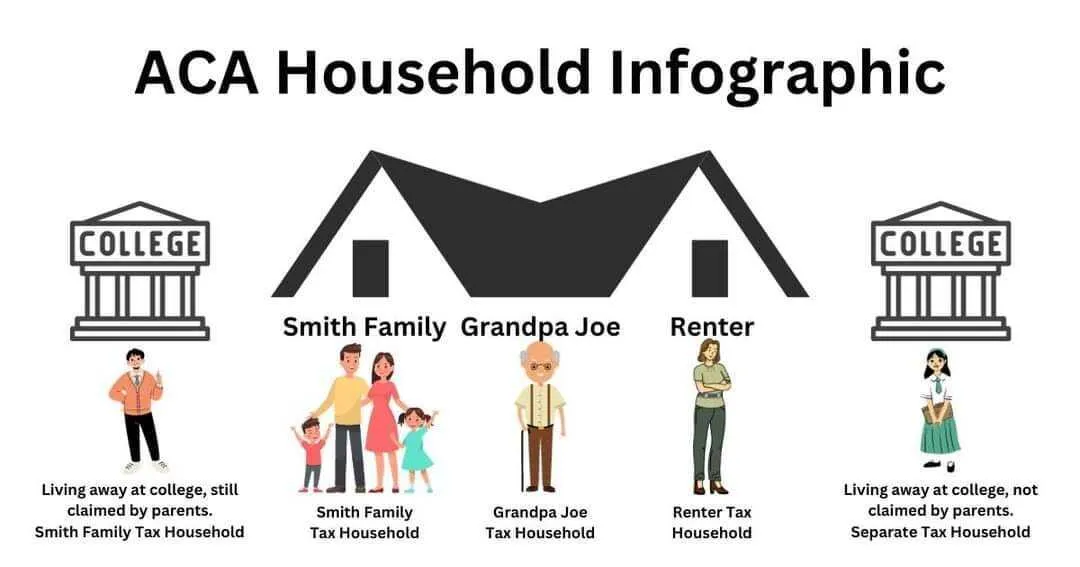

When applying for health insurance through the Marketplace, you’ll need to estimate your Modified Adjusted Gross Income (MAGI).Your tax household includes everyone you claim as a dependent on your tax return, even if they have separate insurance. Here’s a quick guide to help:

Income - What Counts

Gross

BEFORE TAX

Job (Salary, wages, tips)

Unemployment

ALL Social Security

Retirement (IRA/401(K)) Income

Pension Benefits

Disability Income

Alimony Received (>2019)

NET

AFTER TAX

Job (Salary, wages, tips)

Unemployment

ALL Social Security

Retirement (IRA/401(K)) Income

Pension Benefits

Disability Income

Alimony Received (>2019)

Not Applicable

IGNORE

Job (Salary, wages, tips)

Unemployment

ALL Social Security

Retirement (IRA/401(K)) Income

Pension Benefits

Disability Income

Alimony Received (>2019)

Income That Counts:

Wages and salaries (before taxes)

Self-employment income (after business deductions)

Social Security benefits (including retirement and disability, but not SSI)

Retirement or pension income

Unemployment compensation

Rental or royalty income

Alimony (if divorce was finalized before 2019)

Investment income (interest, dividends, capital gains)

Tips or bonuses

Taxable scholarships or grants

Income That Does NOT Count:

Child support

Supplemental Security Income (SSI)

Gifts or financial support from others

Loans

Workers’ compensation

Income tax refunds

Non-taxable VA benefits

Life insurance payouts

For guidance, you can refer to your most recent tax return. This amount will generally be similar to Line 11 on Form 1040 if your income is expected to be close to that amount. If you’re unsure about specific income details, please consult a CPA for assistance.

Self-Employed? Here's How to Estimate Your Income

If you're self-employed—whether you're a freelancer, gig worker, or small business owner—you'll need to estimate your net self-employment income when applying for Marketplace coverage. This is your total income minus business expenses.

What to Include:

Income from freelance or contract work

Earnings from your business or side hustle

Rideshare or delivery income (e.g., Uber, Lyft, DoorDash)

What to Subtract (Allowable Business Expenses):

Office supplies and equipment

Advertising and marketing costs

Business travel and mileage

Home office expenses

Internet and phone bills (portion used for business)

Other allowable business expenses not shown here

Tip: If your income varies, use your best estimate for the entire year. You can update it later if your income changes.

Estimating Unpredictable Income

When your income fluctuates, estimating your annual income can be challenging. Here's how you can approach it:

What to Include:

Review Past Income:

Look at your income from previous years to identify patterns or averages.

Consider Current Trends:

Account for any recent changes in your business that might affect income.

Project Monthly Income:

Estimate your average monthly income and multiply by the number of months you expect to work.

Example: If you earn approximately $1,500 per month from freelance graphic design and plan to work all 12 months:

$1,500 × 12 months = $18,000 estimated annual income

If you also anticipate earning $500 per month from tutoring for 6 months:

$500 × 6 months = $3,000 additional income

Total Estimated Annual Income: $18,000 + $3,000 = $21,000

Note: This is a simplified example. Be sure to account for any business expenses to determine your net income.

⚠️ Important Disclaimer

This page is intended to help you estimate your income for Marketplace purposes. It is not tax advice. Each tax household is responsible for ensuring their income estimate is as accurate as possible. This matters because any Advanced Premium Tax Credit (APTC) received will be reconciled when you file your taxes the following year. If your estimate is too low, you may owe money back. If it's too high, you may get a refund. When in doubt, consult a tax professional. At Mere we are not tax professional

Quick Links

Schedule a Call

Contact Us

Disclaimer

Not affiliated with or endorsed by Medicare, Social Security, Healthcare.gov, or any government agency.

Need Help? The MereCare Team is here for you year-round.

© Copyright 2025. Mere Benefits.